Posted in Triplett & Carothers on September 2, 2021

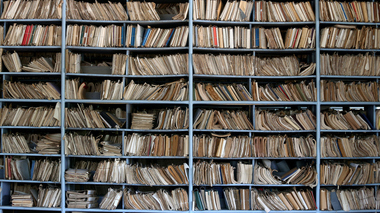

Sometimes it feels good to get rid of clutter. Cleaning out papers we have kept for years is a good project.

But there are some guidelines to be aware of before you put a pile of papers on the scrap heap.

Individual circumstances guide the exact documents that should be retained, but there are some general rules to be familiar with.

- Tax documents:

- As a general rule, copies of income tax returns, as well as any supporting documents (e.g., Forms W-2, 1099, and K-1, expense receipts), should be retained for three years. However, certain events allow the IRS to go back six or seven years, which may mean it is a good idea to keep this documentation for at least six years.

- Form 8606, which documents nondeductible IRA contributions and Roth IRA conversions as well as distributions.

- Form 2439, which reports undistributed long-term capital gains from regulated investment companies and real estate investment trusts.

- Note that the IRS will accept digital copies of these documents. So as long as you keep a digital version of your returns and all supporting documents, the physical versions can be shredded.

- Business documents:

- Paper copies of key binding documents should be retained indefinitely. There are times when physical copies of these documents are needed to provide proof that they are not forged or fraudulent.

- Real estate documents:

- Deeds.

- Title documentation.

- Property surveys.

- Mortgage documents containing the terms of the loan.

- Receipts for improvements to the property.

- Insurance documents.

- Financial documents:

- Loan documents should be kept until the loan is paid off.

- Documentation that a loan has been paid off.

- Brokerage and mutual fund statements.

- Gifts and inheritances:

- Forms 709, 8971 and 706 should be kept indefinitely.

- Personal legal documents:

- Knowing which physical documents to keep can be tricky in the digital era. Many documents are retained in a digital format, but that is not always enough. For example:

- Estate planning documents. Paper copies of all documents relating to the taxpayer’s estate plan, including wills, trusts, powers of attorney and health care proxies, should be kept in a safe place in the home. These documents should be easily accessible in the event of the person’s death or incapacity. Often, copies of these documents are retained by the person’s attorney as well.

- Death-related documents. Death certificates and all estate settlement documents should be retained indefinitely.

- Personal documents. There are a number of documents for which physical copies should be retained indefinitely. These include:

- Social Security cards.

- Marriage certificates and prenuptial agreements.

- Divorce certificates and other related paperwork such as separation agreements and other orders or decrees.

- Birth certificates.

- Adoption paperwork.

- Other important documents related to children or dependents.

- Military documents.

- Most current copies of passports, visas, etc. Foreign nationals should keep copies of their green cards and any other relevant documents.

- Current insurance policies.

- Knowing which physical documents to keep can be tricky in the digital era. Many documents are retained in a digital format, but that is not always enough. For example:

Important caveat: Following these general guidelines is a good start, but do not forget the following three immutable rules:

- Be sure to check the laws in your state before disposing of any official documents.

- Shred all documents containing personal identification information before they are discarded.

- Consult a professional if there is any doubt about whether a document should be kept.

Reach out to Roz Carothers and her team at Triplett & Carothers to learn more.

©2021